A minimum of as soon as in life every person considers moving. Either to a larger residence if the family members is expanding; or to a smaller one, if the kids are leaving as well as the actual residence is mosting likely to be too large for you. Whatever your factor may be, selling a residence is constantly an opportunity.

Home loans, if well utilized might help you to make a good deal from your property’s sell. There are many ideal options, depending on your scenario as well as what you are trying to find. Despite having poor credit rating, and also if you are still settling your home mortgage.

Types Of Residence Loans

There are numerous alternatives to be reviewed within home mortgage, you need to start reviewing initially what is that you intend to do. If you want to change to a bigger house, to a smaller one, as well as just how would you such as to spend the additional advantage gotten from the selling, if any.

There are two essential home loan groups that you ought to consider when thinking about moving. Those are, house purchasing car loans and residence renovation finances.

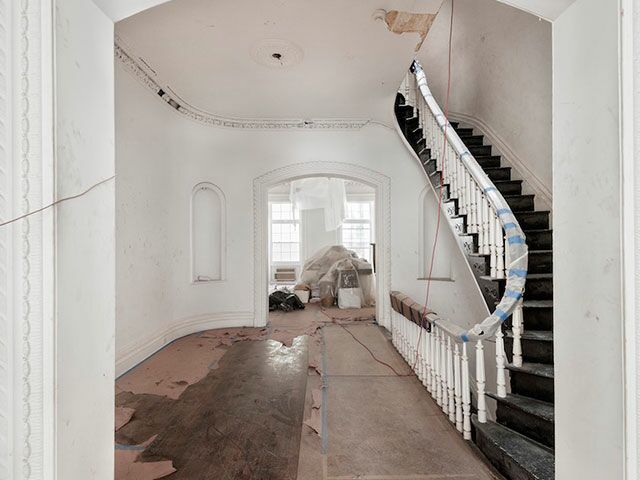

Home improvement financings indicate, as their name says, improve your existing house. Either if there are any reparations to be done, or if you would like to make your home look much better prior to selling it, these kinds of finances may be a good assistance. If you do the right alterations, your home value could be raised by the time you find a purchaser. Financial firms will certainly also accept financings for landscape enhancements, such as building a swimming pool, if that agrees with to increase the home’s worth.

Residence acquiring car loans, in the other hand, are implied to assist you on your brand-new house’s buying.

Different Choices

You will find a wide variety of loans within both, residence improvement as well as house purchasing fundings.

House buying car loans will differ according to what do you intend to do. In instance, if you had bought your real home whit a mortgage which you are still repaying, as well as the residence you are willing to relocate to will certainly additionally need extra financing, you might obtain a home conversion car loan. These kinds of loans, place your real funding into the brand-new house, including the additional quantity you require. If you do not have any type of previous home loan, you can have a mortgage or a residence equity financing, simply over the added quantity you need to get your new residence.

You will likewise find several options on residence enhancement fundings, the most common are unsecured individual car loans for house improvements, home mortgage refinancing, first home loan and also 2nd findings. Learn more about Jumbo Loans Dallas in this link.

Unsafe individual fundings may be a little bit extra pricey than safe lendings because they represent more danger for the loan provider, but you will certainly not require to have equity in your residential or commercial property or any other security to use. Credit score might be a restriction for the obtained quantity, however you are still qualified even if you have poor debt.

Home mortgage refinancing as well as very first mortgage loans, are excellent options to examine if you have bought your house with a mortgage. Very first mortgage are offered by your current loan provider, to finance your residence improvements over your existent home mortgage. With home mortgage re-financing your real mortgage will certainly be refinanced. You will not be obtaining more money, but refinancing will lower your home mortgage monthly payments leaving you extra money to spend for boosting your home.

2nd financings appropriate if you have an equity in your residential property to justify the loan.

All these choices, if well made use of may help you to obtain the most effective of your building’s sell. Try to browse and also compare as lots of lenders as you can prior to you determine to apply for any kind of finance.